HOP – Passport to Prosperity

- About Us

- Professional Certifications

- IT Skills

- Trainings & CPE

- Overview

- Time & Stress Management

- Conflict Management

- Team Building & Leadership Skills

- Finance for Non-Finance Professionals

- Cost Management for Non-Commerce Professionals

- Corporate Governance in Public Interest Companies

- Emotional Intelligence

- Systematic Inventive Thinking

- Professional Ethics

- Entrepreneurship & Innovation

- Consulting Services

- Membership Network

- Think Tank & Advocacy

- About

Us - Professional

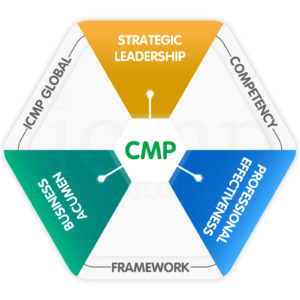

CertificationsHouse of Professionals is offering Leadership, Management, and Specialized Certification programs in collaboration with the Institute of Chartered Management Professionals, USA with the objective to enhance the skills set and productivity of individuals. As the vital factor that catch employers are the professional certifications on candidate’s profile which encourage them to select and promote the person from the pool of several candidates.

- IT

SkillsProgramming & Tech

E-Commerce

Graphics & Design

Digital Marketing

Accounting

Office Management

- Trainings &

CPE - Consulting

ServicesIT Services

Engineering Services

- Membership

Network - Think Tank &

Advocacy

- About

Us - Professional

CertificationsHouse of Professionals is offering Leadership, Management, and Specialized Certification programs in collaboration with the Institute of Chartered Management Professionals, USA with the objective to enhance the skills set and productivity of individuals. As the vital factor that catch employers are the professional certifications on candidate’s profile which encourage them to select and promote the person from the pool of several candidates.

- IT

SkillsProgramming & Tech

E-Commerce

Graphics & Design

Digital Marketing

Accounting

Office Management

- Trainings &

CPE - Consulting

ServicesIT Services

Engineering Services

- Membership

Network - Think Tank &

Advocacy

Council of Banking and Fintech Professionals

Purpose:

The Council of Banking and Fintech Professionals is established as a strategic platform for professionals working across banking, digital finance, and emerging financial technologies to enhance their knowledge, expertise, and readiness for the evolving financial ecosystem. Its mission is to promote continuous learning, digital competency, policy awareness, and innovation in areas such as retail and corporate banking, digital payments, cybersecurity, blockchain, Web 3.0, artificial intelligence in financial services, financial inclusion, reg-tech, and other transformative fintech trends. The Council also aims to serve as a bridge between industry practitioners, regulators, and policymakers to support informed decision-making and responsible innovation.

Objectives:

- Professional Development: To deliver ongoing learning opportunities through CPE programs, training sessions, and certification pathways covering emerging trends in banking operations, risk and compliance, digital payments, cybersecurity, blockchain, decentralized finance (DeFi), artificial intelligence (AI), and Web 3.0 applications in financial services.

- Knowledge Sharing: To provide a structured forum for exchanging ideas, innovative practices, and real-world case studies through seminars, roundtables, webinars, and conferences focusing on digital transformation within the banking and fintech sectors.

- Technical Support and Resources: To create and maintain a repository of research papers, regulatory updates, case studies, and industry reports related to banking technologies, cyber risk, fintech regulations, open banking, digital lending, and financial inclusion, enabling informed decision-making.

- Standards, Compliance & Regulatory Updates: To keep members informed about the latest developments in banking regulations, prudential standards, anti-money laundering (AML), know-your-customer (KYC) and customer due diligence (CDD) frameworks, data protection laws, payment regulations, cybersecurity guidelines, and evolving frameworks governing digital assets and Web 3.0 ecosystems.

- Advisory & Policy Support: To offer expert insights and recommendations to government authorities, central banks, regulatory bodies, and policy think tanks on matters related to digital finance, consumer protection, fintech regulation, reg-tech adoption, cybersecurity, and financial inclusion strategies.

- Industry Networking and Collaboration: To foster a collaborative ecosystem where banking and fintech professionals, innovators, academia, and regulators can network, share experiences, and explore partnerships for knowledge exchange, innovation acceleration, and capacity building.

Council Members

Chairman

Nazish Ali

Mr. Nazish Ali is a seasoned banking professional with over 30 years of diversified experience spanning Commercial Banking, Microfinance, Electronic Money Institutions (EMIs), and Fintech. His career is marked by leadership roles across various domains including Operational Risk & Compliance, Alternate Delivery Channels (ADC) such as wallet issuance, ATM, POS, and e-commerce, as well as Retail and Consumer Banking, Bancassurance, and Microfinance operations.

Mr. Ali has played instrumental roles in establishing and scaling digital financial services, contributing significantly to the launch and operational success of multiple fintech and EMI ventures. His expertise covers a broad spectrum of functions including Credit Administration, Compliance, General Services, and Strategic Operations.

He has successfully completed the Director Training Programme from the State Bank of Pakistan (SBP) and is now listed in the Securities and Exchange Commission of Pakistan (SECP)’s directory of certified directors.

Currently, Mr. Nazish Ali is serving as the President & CEO of Apna Microfinance Bank Limited, where he is leading the organization through a transformative digital and operational growth journey. Prior to this, he held key leadership positions as Country Head of Operations at Opay (Fintech) and TAG Innovation (EMI), where he was pivotal in driving operational excellence and digital innovation.

Over the course of his career, he has also served in senior capacities at leading financial institutions including UBL, The Bank of Punjab, Faysal Bank, and previously at Apna Microfinance Bank, contributing to their strategic development and operational efficiency.

Mr. Nazish Ali’s extensive experience and visionary leadership make him a valuable asset to any advisory board focused on financial inclusion, fintech innovation, and digital transformation in banking.